How Can a CPA Accounting Firm Help with Tax Planning?

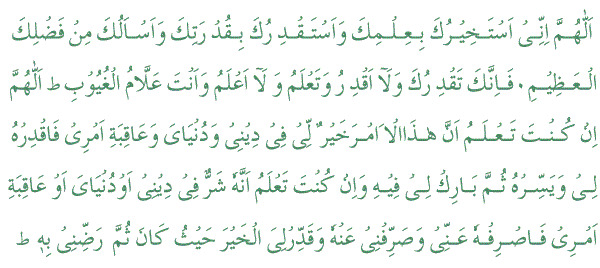

Tax planning is a crucial component of financial management for individuals and businesses alike. It involves organizing one’s financial affairs in a way that minimizes tax liabilities while maximizing available tax benefits and incentives. A well-executed tax plan can help avoid costly errors, reduce the risk of audits, and enhance long-term financial stability. One of the best ways to navigate the complexities of tax planning is by working with a CPA (Certified Public Accountant) accounting firm.

CPA accounting firms possess specialized knowledge and experience that enable them to offer valuable advice and strategies for minimizing tax burdens and ensuring compliance with tax laws. In this article, we will explore how a CPA accounting firm can assist with tax planning and help businesses and individuals optimize their tax position.

Note: CPA accounting firm in Dubai helped numerous businesses with accurate financial planning and tax strategies. CPA Auditing provided expert advice to streamline operations and ensure compliance. Contact CPA Auditing today for professional assistance in managing your finances and maximizing tax savings in Dubai.

The Role of a CPA Accounting Firm in Tax Planning

A CPA accounting firm provides professional services that go beyond simply filing tax returns. Tax planning is a forward-looking approach that aims to reduce taxes over the long term by strategically managing financial decisions. By leveraging their expertise, CPAs can create customized tax strategies that align with a client’s financial goals and objectives.

Expert Knowledge of Tax Laws

One of the most significant ways a CPA accounting firm contributes to tax planning is through its in-depth understanding of tax laws and regulations. Tax laws are constantly changing, and navigating the various federal, state, and local tax codes can be a daunting task for individuals and businesses. CPAs stay up to date with these changes, ensuring that their clients benefit from the latest tax credits, deductions, and incentives.

By working with a CPA, individuals and businesses can stay compliant with tax laws and avoid costly penalties for non-compliance. Additionally, CPA accounting firms help identify tax-saving opportunities that clients may not be aware of, ensuring that they don’t overpay their taxes.

Comprehensive Financial Analysis

A key element of tax planning is conducting a thorough analysis of an individual’s or business’s financial situation. CPA accounting firms have the expertise to assess income, expenses, investments, and other financial aspects in order to develop a tax-efficient strategy. By examining the full scope of a client’s financial profile, CPAs can recommend specific tax-saving measures, such as retirement account contributions, capital gains planning, and tax-deferred investments.

For businesses, this comprehensive analysis extends to evaluating operational structures, such as the most tax-efficient ways to organize the business entity—whether as a sole proprietorship, corporation, LLC, or partnership. By identifying areas where tax advantages can be gained, a CPA firm can develop a customized tax plan that ensures the client’s financial decisions are optimized for tax purposes.

How CPA Accounting Firms Help Minimize Tax Liabilities

One of the main goals of tax planning is to minimize tax liabilities in a legal and ethical manner. CPA accounting firms employ a variety of strategies to achieve this, helping businesses and individuals reduce the amount of taxes they owe while still remaining compliant with tax regulations.

Maximizing Deductions and Credits

One of the most effective ways to reduce tax liability is by maximizing available deductions and credits. Deductions reduce taxable income, while credits directly reduce the amount of tax owed. A CPA accounting firm helps identify deductions and credits that clients may qualify for, ensuring that no potential tax savings are overlooked.

For example, individuals may be eligible for deductions related to mortgage interest, medical expenses, or charitable contributions. Businesses can take advantage of deductions for operational costs, research and development, and employee benefits. A CPA accounting firm ensures that these deductions are properly applied and that clients are fully benefiting from tax-saving opportunities.

Tax-Deferred Investments

Tax-deferred investments provide a powerful tool for reducing tax liabilities. They allow individuals and businesses to postpone paying taxes on income until a later date, typically when they withdraw or realize the income. Examples of tax-deferred investments include retirement accounts like 401(k)s and IRAs, as well as certain insurance policies and annuities.

CPA accounting firms help clients understand the benefits of tax-deferred investments and guide them in selecting the right vehicles for their financial goals. By contributing to tax-deferred retirement plans, individuals can reduce their taxable income in the short term while building wealth for the future. For businesses, tax-deferred investment strategies can provide significant long-term benefits for both owners and employees.

Structuring the Business for Tax Efficiency

For business owners, structuring the company in the most tax-efficient way is an essential part of tax planning. A CPA accounting firm can advise on the best legal structure for the business, taking into account factors such as ownership, liability, and taxation. For instance, the choice between forming an LLC, corporation, or partnership can have significant tax implications.

A CPA can also guide business owners on how to allocate resources, plan capital expenditures, and take advantage of tax incentives such as deductions for business equipment, research credits, or energy-efficient initiatives. By carefully structuring the business and making strategic decisions, business owners can optimize their tax position and reduce their overall tax liability.

Estate and Gift Tax Planning

Another important area of tax planning is estate and gift tax planning. Individuals with significant assets or wealth need to consider the potential tax implications of transferring assets to heirs or beneficiaries. CPA accounting firms provide valuable assistance in developing strategies to minimize estate taxes and maximize the transfer of wealth.

CPAs help clients take advantage of estate planning tools such as trusts, gifting strategies, and charitable donations. By using these tools effectively, clients can reduce estate taxes, ensure their wealth is distributed according to their wishes, and minimize the tax burden on their heirs.

CPA Accounting Firms and Tax Compliance

In addition to helping clients minimize taxes, CPA accounting firms also ensure compliance with tax laws and regulations. Tax compliance is a critical part of tax planning, as failure to comply with tax requirements can result in penalties, interest, and even legal consequences. CPA firms play an important role in ensuring that clients file their tax returns accurately and on time.

Accurate Tax Filings

A CPA accounting firm ensures that clients’ tax returns are prepared accurately and in accordance with tax laws. They use their expertise to identify potential issues with tax filings and resolve them before submission. By working with a CPA, businesses and individuals can avoid common mistakes that could lead to tax audits or penalties.

Representing Clients in Tax Audits

In the event of a tax audit, CPA accounting firms can represent clients before the tax authorities. Having a CPA on your side during an audit ensures that the process goes smoothly and that all necessary documentation is provided. CPAs are skilled in navigating the complexities of tax audits and can help clients resolve issues efficiently and effectively.

The Long-Term Benefits of Tax Planning with a CPA Firm

The benefits of working with a CPA accounting firm for tax planning extend far beyond the immediate tax savings. By developing a strategic tax plan, clients can achieve long-term financial success and stability. Whether for individuals or businesses, a CPA’s expertise in tax planning can lead to:

Better Financial Decision-Making

By understanding the tax implications of various financial decisions, clients can make better choices about investments, savings, and business strategies. Tax planning with a CPA ensures that clients have the information they need to make informed decisions.

Improved Cash Flow Management

A solid tax plan helps businesses and individuals optimize their cash flow by reducing unnecessary tax payments. By minimizing tax liabilities and maximizing deductions, clients can retain more of their income, which can be reinvested into the business or used to improve personal financial security.

Enhanced Wealth Building

For individuals, tax planning is a critical part of wealth-building strategies. By using tax-efficient investment vehicles and deferring taxes through retirement accounts, clients can grow their wealth over time. For businesses, tax planning ensures that profits are reinvested effectively, fostering growth and long-term sustainability.

Conclusion

In conclusion, a CPA accounting firm plays a crucial role in helping businesses and individuals with tax planning. Through expert knowledge of tax laws, comprehensive financial analysis, and strategic advice, CPA firms can help clients minimize their tax liabilities while ensuring compliance with regulations. By structuring businesses efficiently, maximizing deductions, and taking advantage of tax-deferred investments, CPAs provide invaluable support in optimizing financial outcomes.

Whether for tax savings, long-term wealth-building, or ensuring compliance, working with a CPA accounting firm is a sound investment for anyone seeking to navigate the complexities of tax planning. With the guidance of a trusted CPA, businesses and individuals can achieve their financial goals and secure their financial future.

In conclusion, tax planning is a critical element for both individuals and businesses seeking to optimize their financial positions. By working with a CPA accounting firm, clients can benefit from expert guidance in navigating complex tax laws, maximizing deductions, and minimizing liabilities. Furthermore, a proactive tax strategy helps businesses and individuals plan for the future, ensuring financial stability and growth. As a result, with the assistance of a trusted CPA, clients can make informed decisions, achieve compliance, and ultimately secure a more favorable financial outcome. Therefore, engaging a CPA firm is a valuable investment for long-term financial success.

For More Insightful Articles Related To This Topic, Feel Free To Visit: bloggingshub.com